FRM VS CFA

AS WE ALL KNOW THAT THESE TWO ARE ONE OF MOST POPULAR COURSES AMONG YOUNGSTERS INTERSTE IN WORLD OF FINANCE, AND AS USUAL THERE ARE A BIG CONFUSION THAT WHICH IS BETTER FOR AN INDIVIDUAL IN TERMS OF SCOPE, FINANCIALS, GROWTH, RECOGNITION ETC.

SO BY REMEMBERING ALL THESE FACTORS WE HAVE DECIDED TO GAVE A DETAILED ANALYSICS ON THIS TOPIC. THIS WILL COMES IN PARTS BECAUSE THIS IS A VERY HUGE TOPIC TO COVER AND IF WE COVER THIS IN ONE BLOG THIS WILL GOING TO BE VERY LONG AND YES BOARING ALSO, SO FIRST PART WILL TELL ABOUT THE DIFFERENCE OF COURSE STRUCTURE, TIME DURATION, FEES STRUCTURE, SUBJECTS ETC.

Course Structure :- FRM

FRM Course Details

| Course | FRM |

| Full form | Financial Risk Management |

| Eligibility | Minimum graduation |

| Duration | Exams will be conducted twice in a year |

| Fee Offered for exam | $ 300 - 350 |

| Course Type | Certified Exam |

| Starting salary offered | INR 900,000 |

| Advance Courses | Advance Certificate in Financial Accounting, Advance Certificate in Financial Statement Analysis |

| Employment opportunities | Market Risk Manager, Regulatory Risk Manager, Commercial Risk Manager |

FRM Course Duration

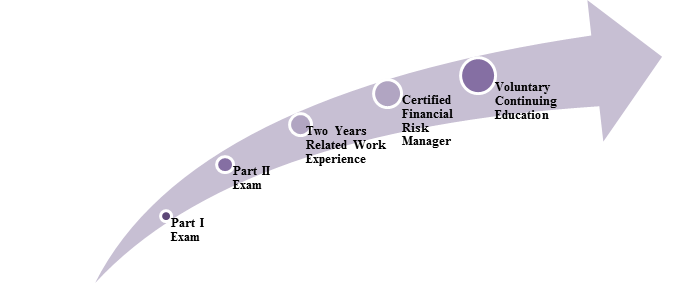

Based on the aspirant’s focus and dedication, it takes a minimum of 1 year to finish both the exams of the FRM course. Candidates can give the exams of FRM Part I and Part II in May and November. Also, there is FRM exam validity for 5 years from the date of registration. That means the aspirant should clear both the exams and get 2 years of experience, and acquire the certificate within these 5 years. However, to become a Certified Financial Risk Manager, aspirants must meet with the following outline of the program:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FRM LEVELSFee Structure :-The estimated Financial risk management certification Fee Structure is mentioned below. Make use of the below points and know the application and examination fee structure for 2 papers by verifying further. To have a prior idea on the FRM Certification Fees, we have provided the fee structure here: Part I

Part II

As there is no fee for the exam of FRM Certification. Candidates have to pay the fee for registration and that would be taken in the amount of Exam as mentioned above. You can only register for the exam in an online mode. Candidates can expect the registration process on the dates of continuity months. ~ Subjects :- FRM Part I Exam Pattern & Syllabus :-

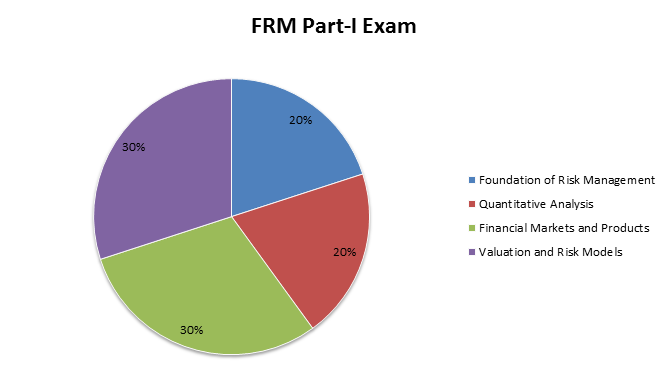

One of the first steps that you should fulfill to become a Certified Financial Risk Manager is clearing the FRM Part I Exam. Aspirants should know about the exam pattern and concepts & theories involved under risk management and what should be included to a risk manager’s daily work. Every year, the exam of FRM Part I will be conducted in May and November months. So, candidates need to concentrate on the required Part I important tools and concepts to clear the exam. There are 100 MCQs to be solved within 4 Hours. The below diagram portrays the subjects that the aspirants are expected to prepare for the level I exam with their respective weightage. FRM Part II Exam Pattern & Syllabus :-

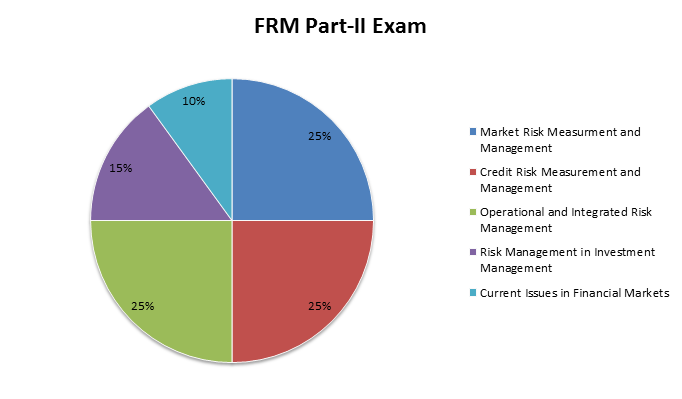

Second step candidates should follow after qualifying the part 1 exam of FRM is the Financial Risk Manager Exam Part II. They have to clear this FRM part 2 exam also to become a certified FRM. The FRM Exam Part II centers on the practical application of risk management tools involved in Part I to particular areas of risk management like credit risk, market risk, and operational risk. Aspirants can take this exam in May and November every year. You will be seen 80 multiple choice questions to attempt within 4 Hours of exam duration. The below diagram narrates the subjects with their respective weightage, which are supposed to prepare by the candidates for the level II FRM Exam. Course Structure :- CFA CFA Course StructureChartered financial Analyst program is structured into three levels (Level 1, Level 2, and Level 3). For most of the students CFA course duration takes 2 to 5 years to complete the chartered financial analyst course. There is no limit to number of times you can attempt the course. CFA Level 1: Focuses more on the basic knowledge of investment tools with some analysis, BASIC CONCEPTS OF INVESTING RELATED THINGS AND MANY OTHER STUFFS ALSO. CFA Level 2: Focuses more on application of investment tools and concepts along with improving analysis, practical implications in various situations etc. CFA Level 3: Focuses more on concepts and analytical methods for effective portfolio management and wealth. CFA Course FeesThere is a onetime enrollment fees. You have to pay this at the time of registration of CFA Level 1. And there is an exam registration fees. Seethe CFA exam registration fees details below.

The CFA course fees like program CFA enrollment fees and CFA registration fees are payable in US dollars only. You cant pay CFA course fees in rupees. Chartered financial analyst course fees of registration covers the cost of the following.

|

0 Comments